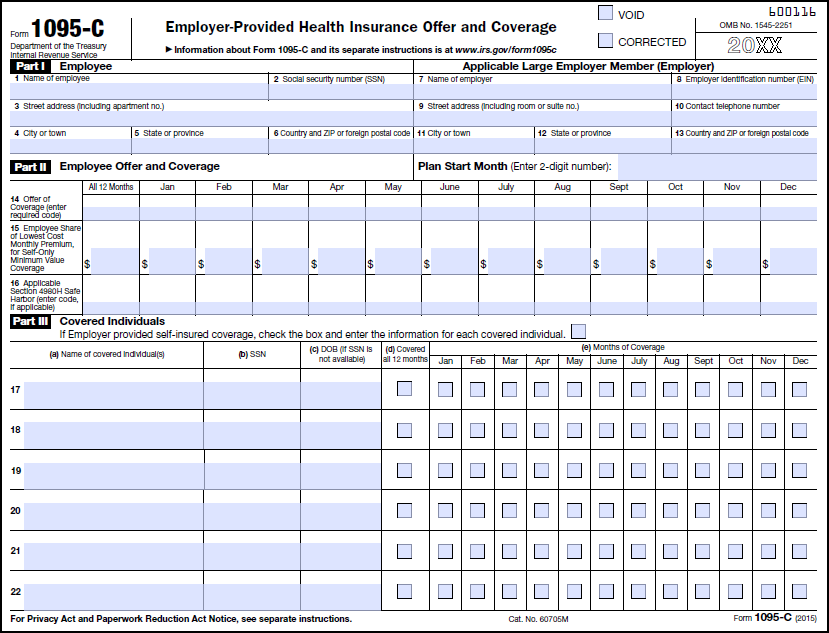

Your 1095C Tax Form for You will soon receive your 1095C via US Mail for the tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as partInst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095BNov 07, · Form 1095C is sent out to those who enrolled in a health plan through the Health Insurance Marketplace In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled in

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

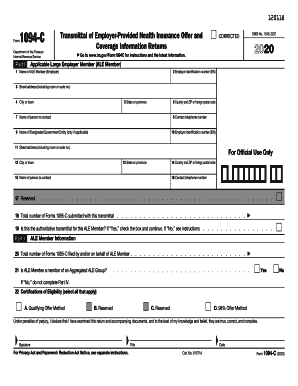

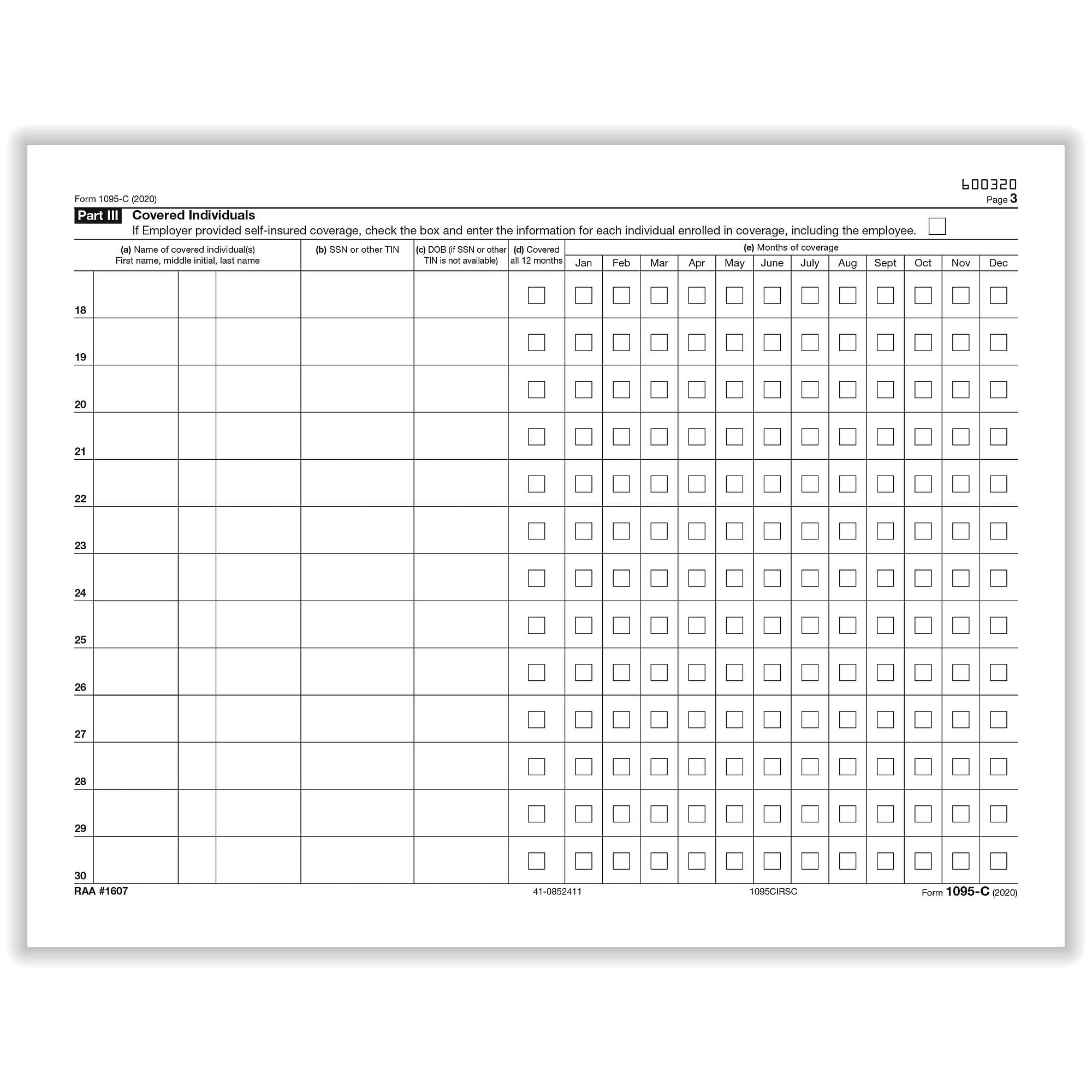

1095 c form 2020 instructions

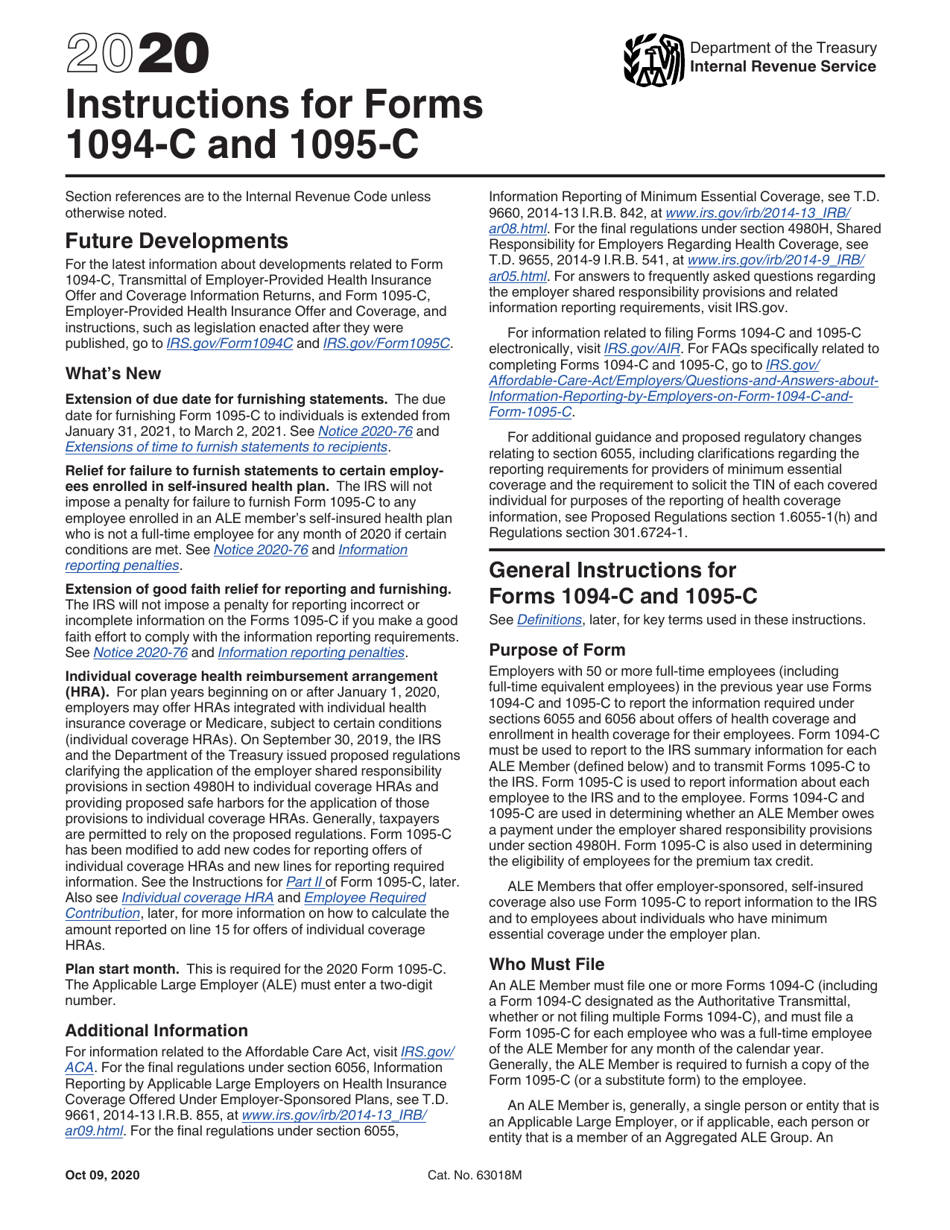

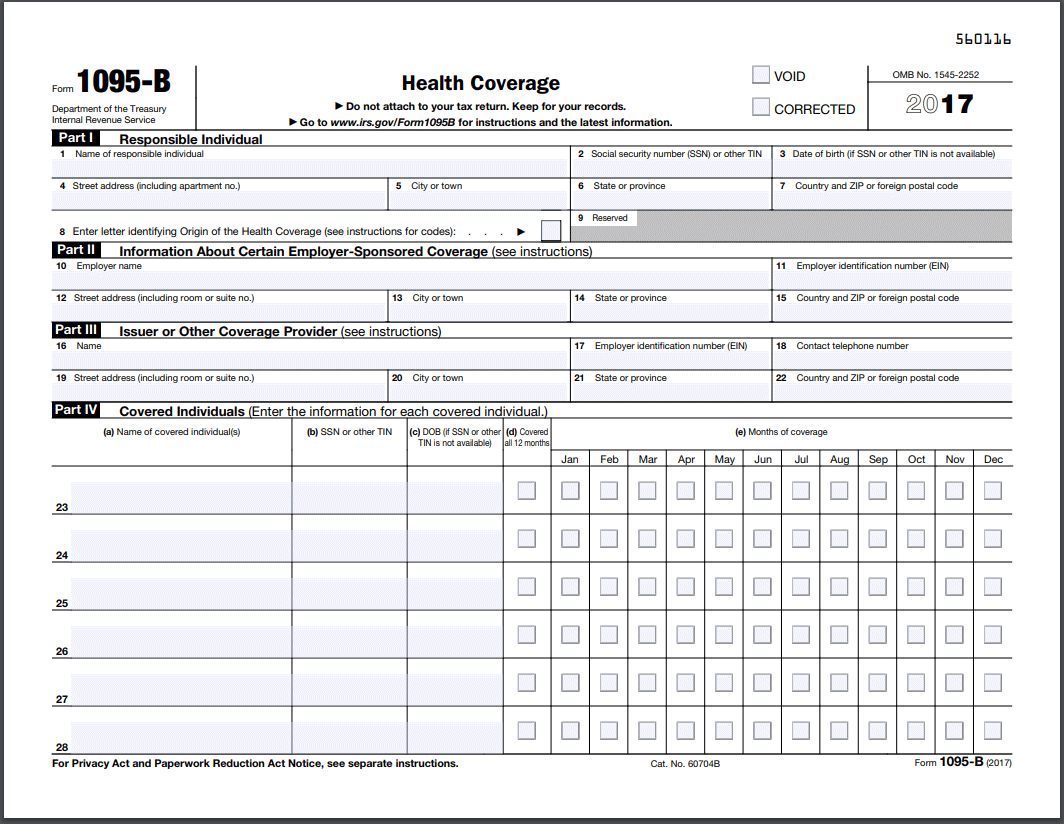

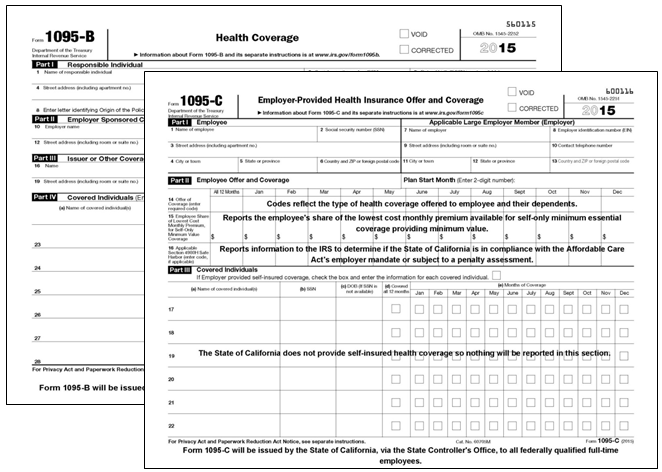

1095 c form 2020 instructions-If you and your dependents had qualifying health coverage for all of Check the "Fullyear coverage" box on your federal income tax form You can find it on Form 1040 (PDF, 147 KB) If you got Form 1095B or 1095C, don't include it with your tax return Save it with your other tax documents Health care tax resources Tax forms andJan 01, 15 · Page 2 FTB Pub 35C (NEW ) California Instructions for Filing Federal Forms 1094C and 1095C References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 15, and to the California Revenue and Taxation Code (R&TC) What's New

trix Irs Forms 1095 C

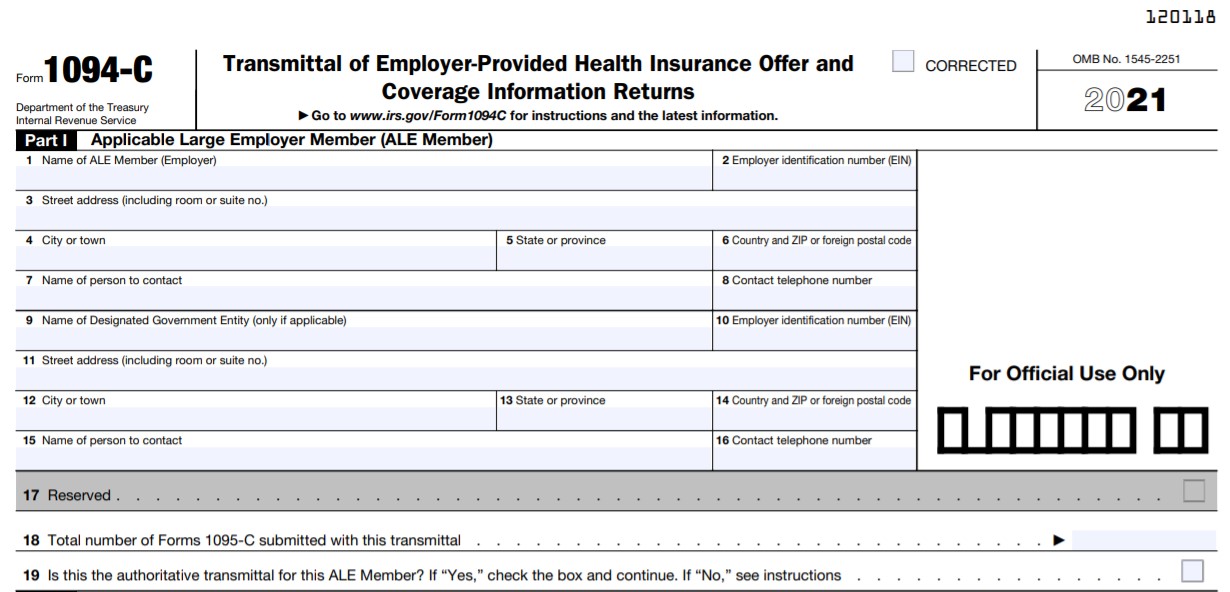

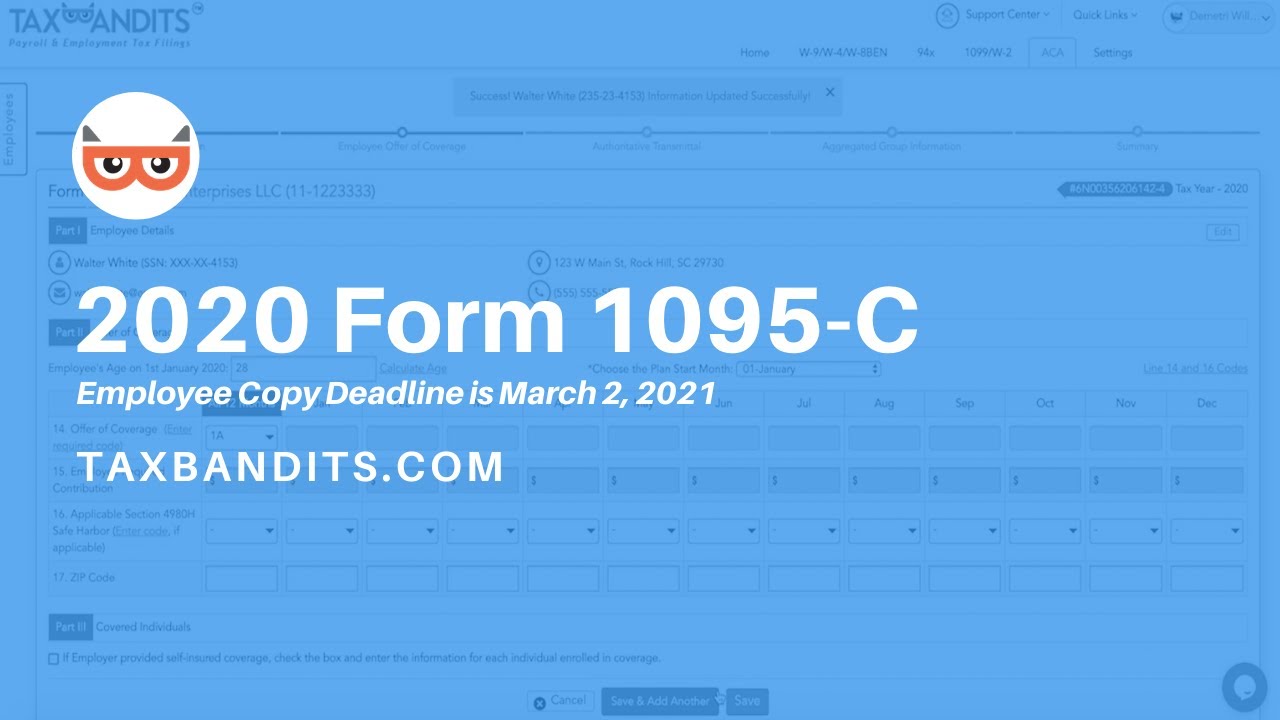

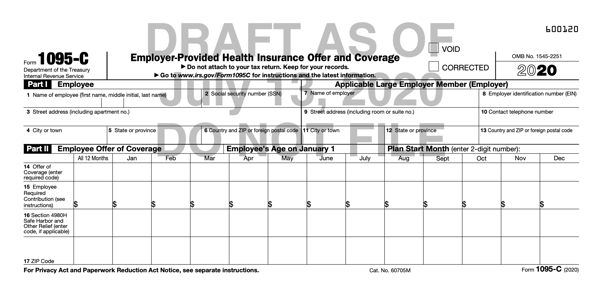

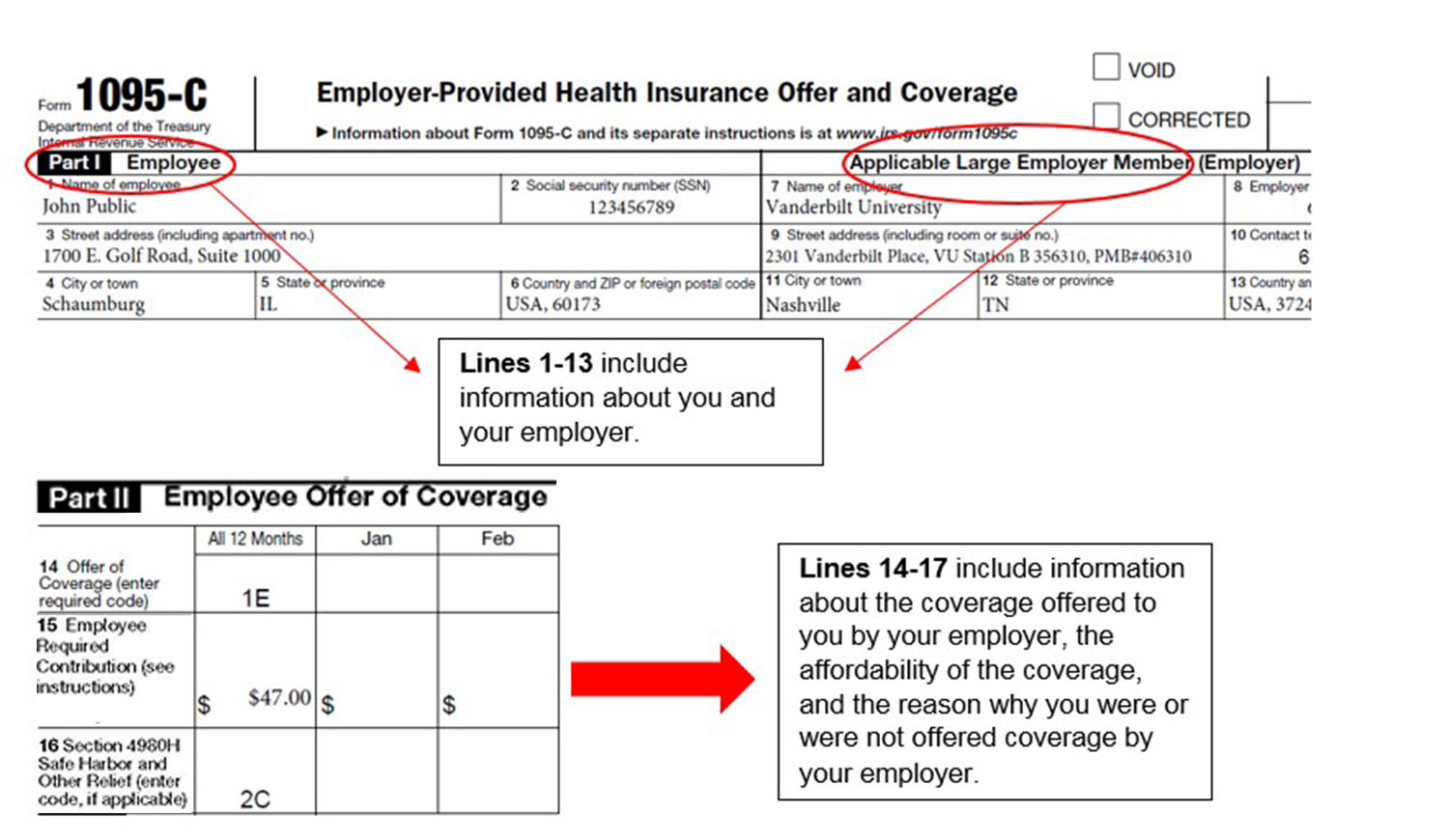

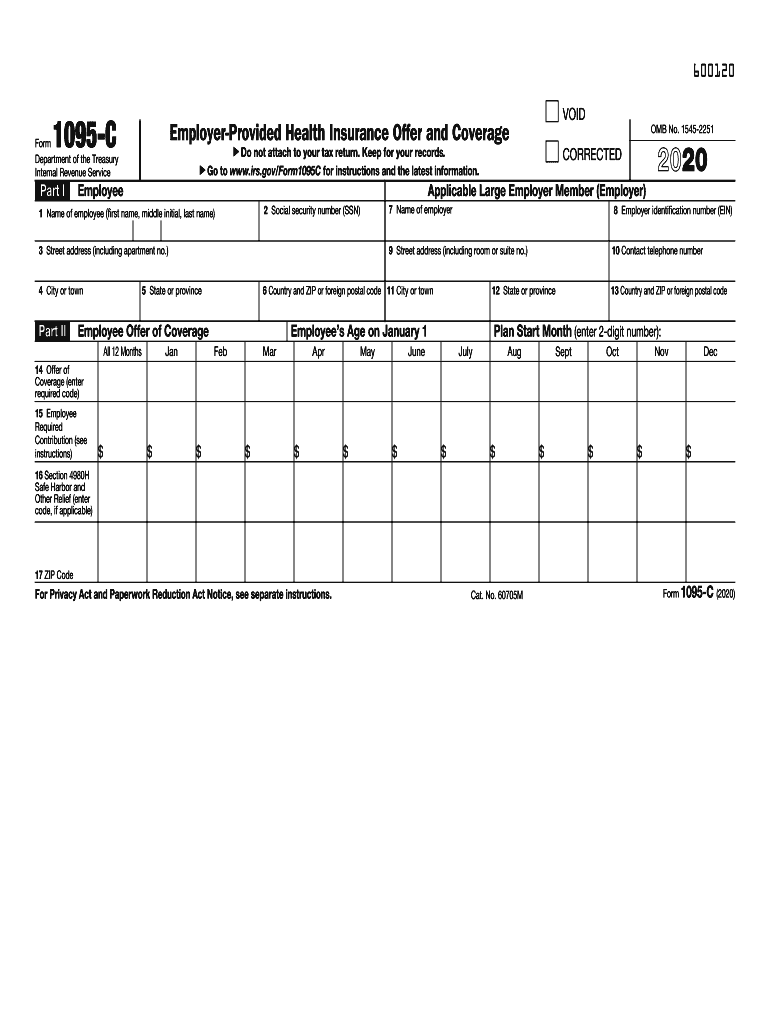

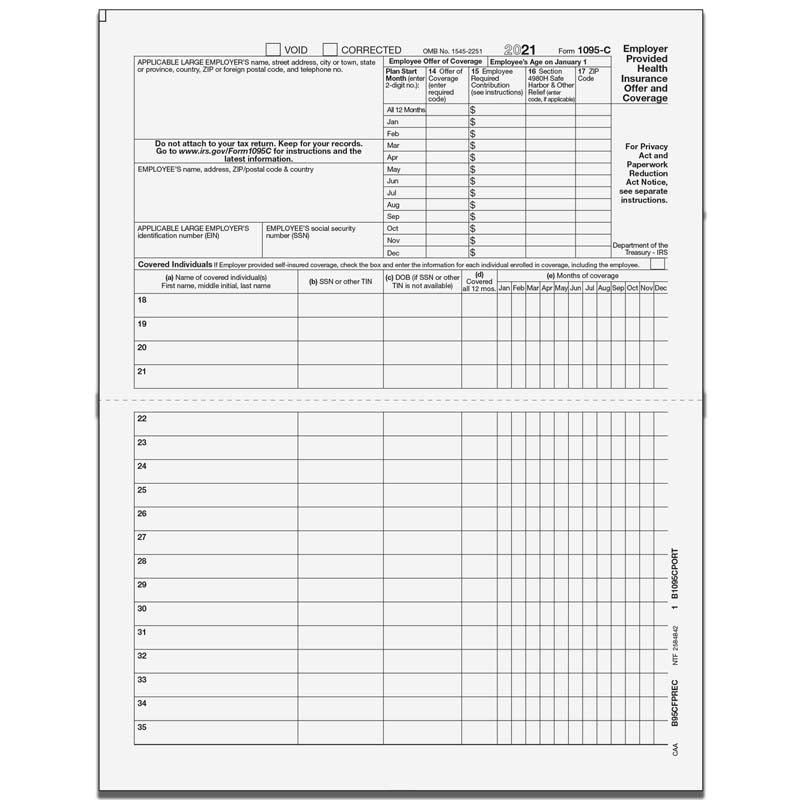

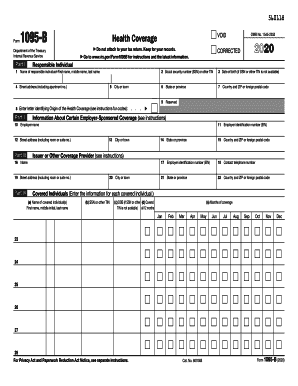

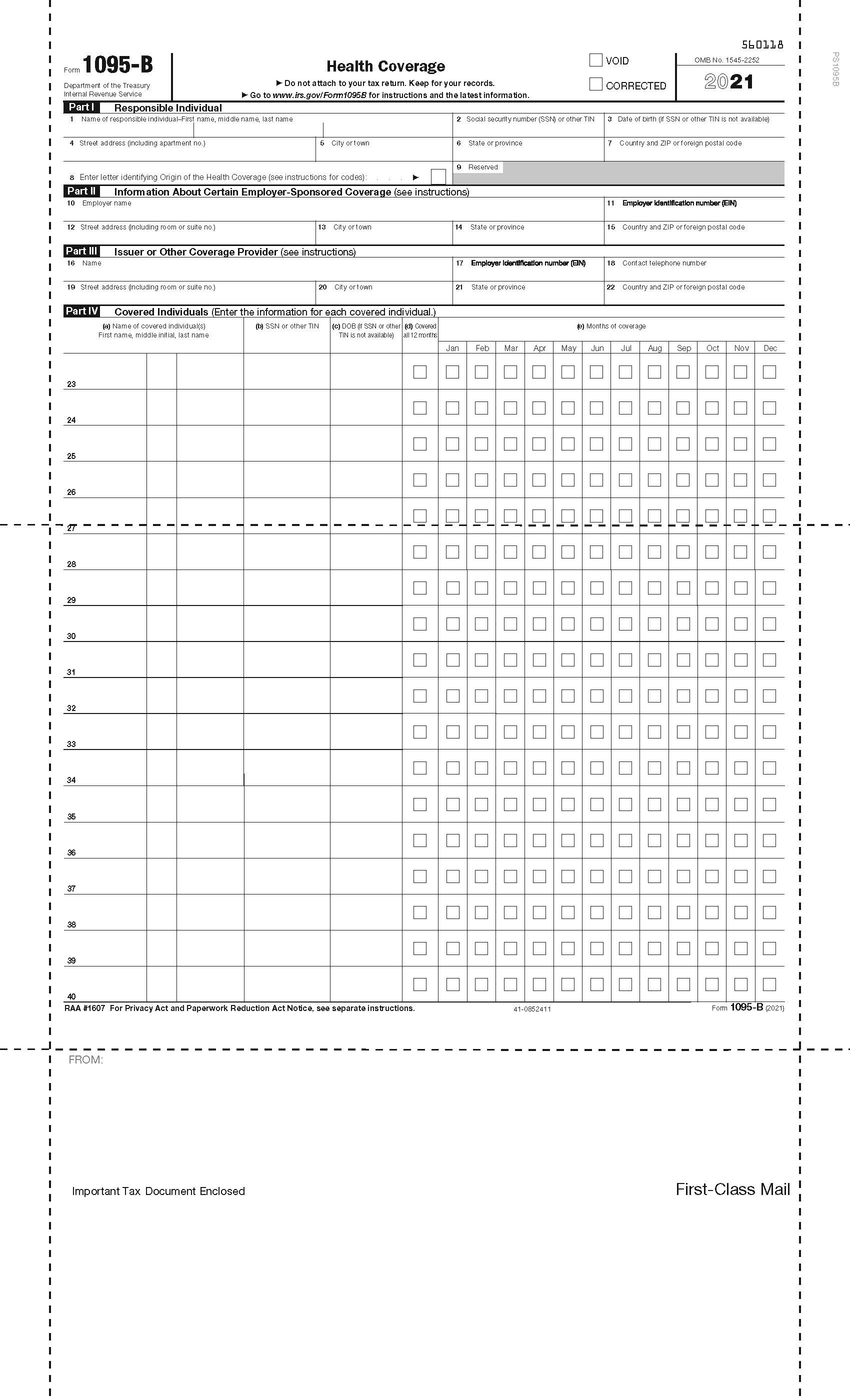

Feb 09, 21 · Federal employees and annuitants with Federal Employees Health Benefits (FEHB) coverage will soon receive the Internal Revenue Service (IRS) Forms 1095B and 1095C The information contained on these forms will help you complete your tax return Form 1095B, Health Coverage If you are enrolled in FEHB, your health plan will send an IRS Form 1095B toMar 02, 21 · On Oct 2, , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from Jan 31, 21Mar 02, · The 1095C forms were modified slightly, primarily to facilitate reporting by employers who offered individual coverage HRAs (ICHRAs) in The Form 1094Cs are pretty much identical to last year Minor Changes to Form 1095C For the first time, employers must report the plan year start month in Part II of the Form 1095Cs

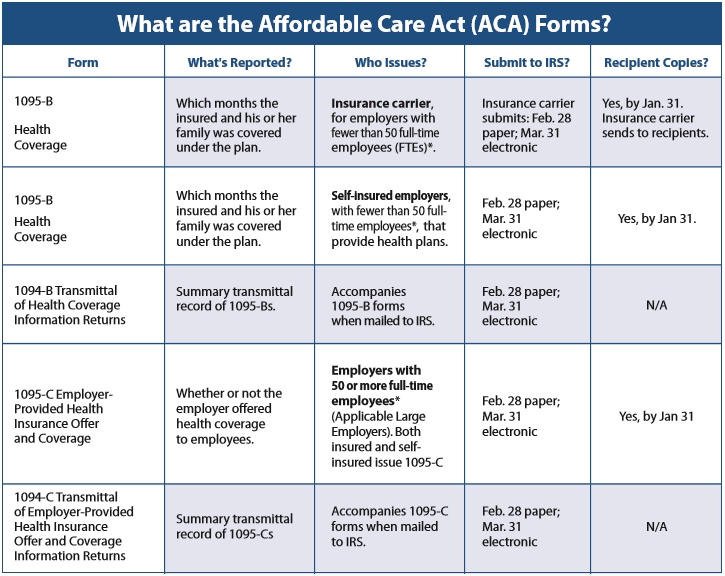

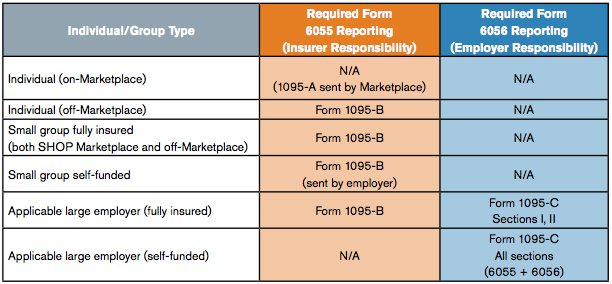

Get IRS 1095C 21 Get form Show details You or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the premium tax credit If your employer provided you or a family member health coverage through an insured health plan or in another manner, you may receive information about theJan 18, 15 · The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage,Premium tax credits used;

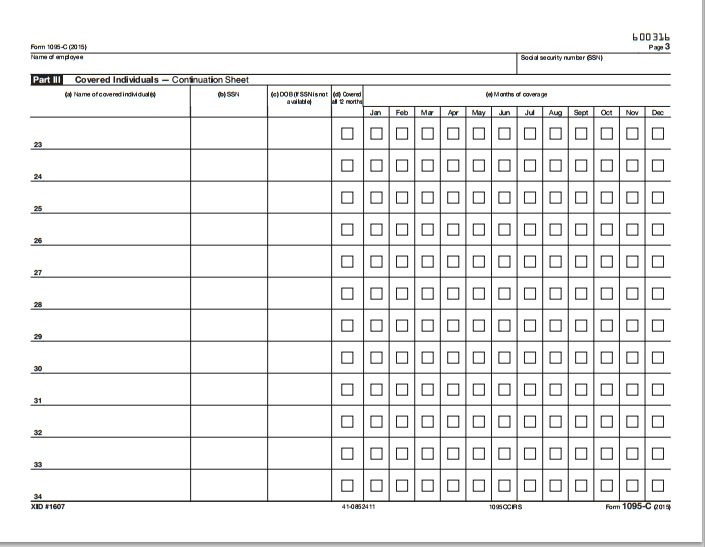

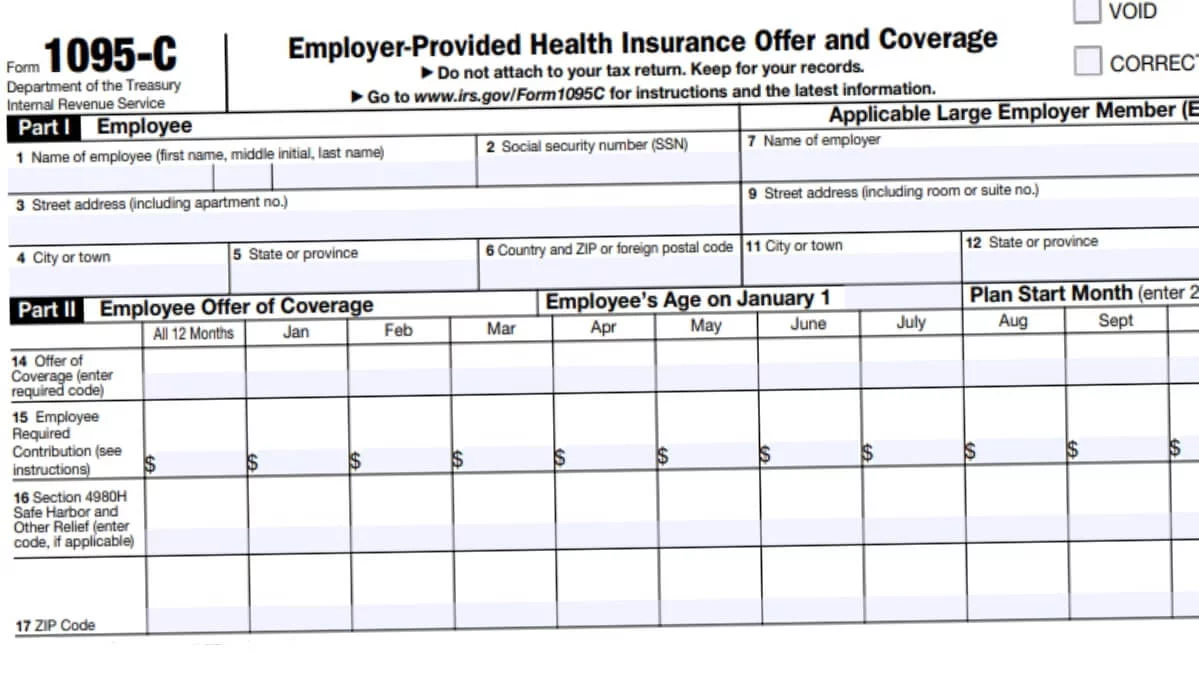

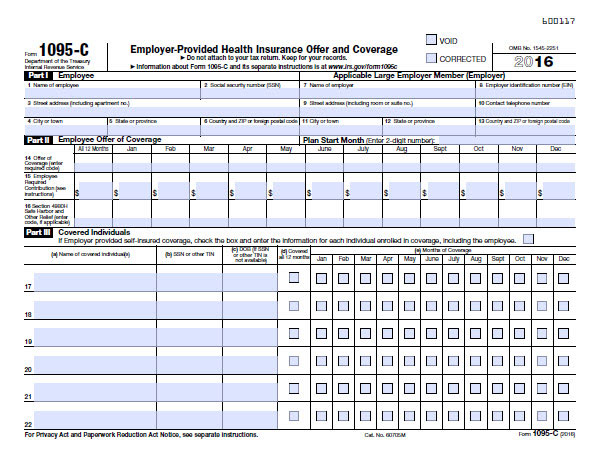

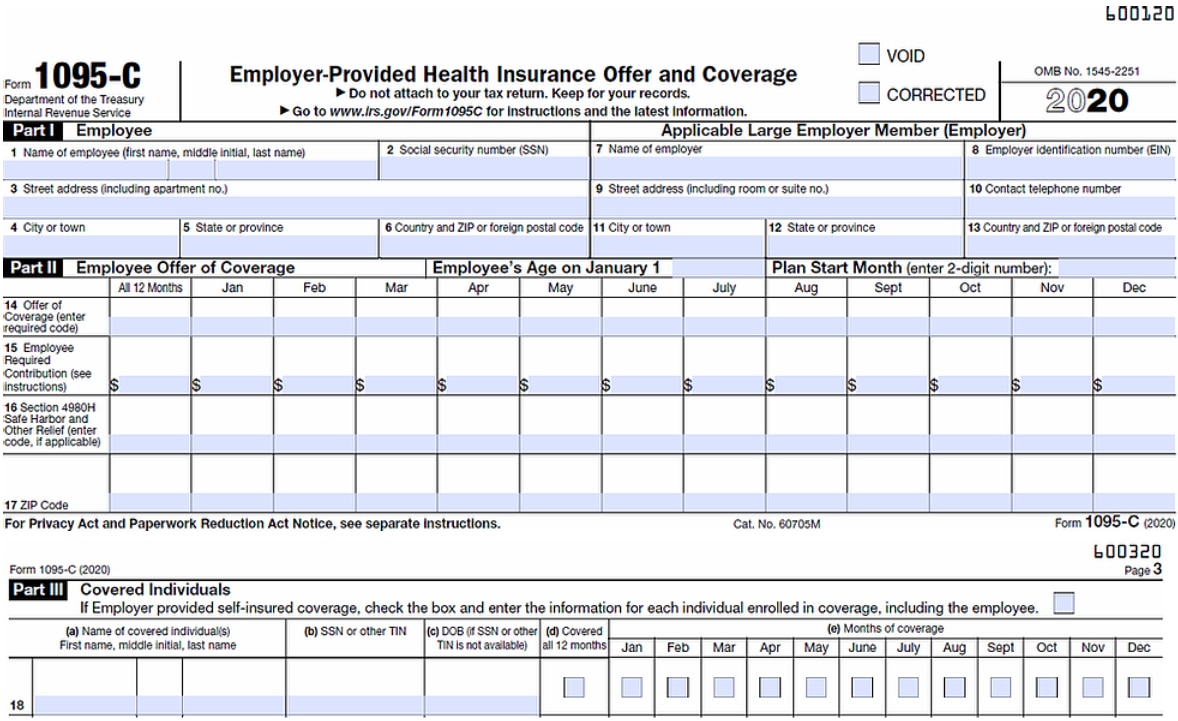

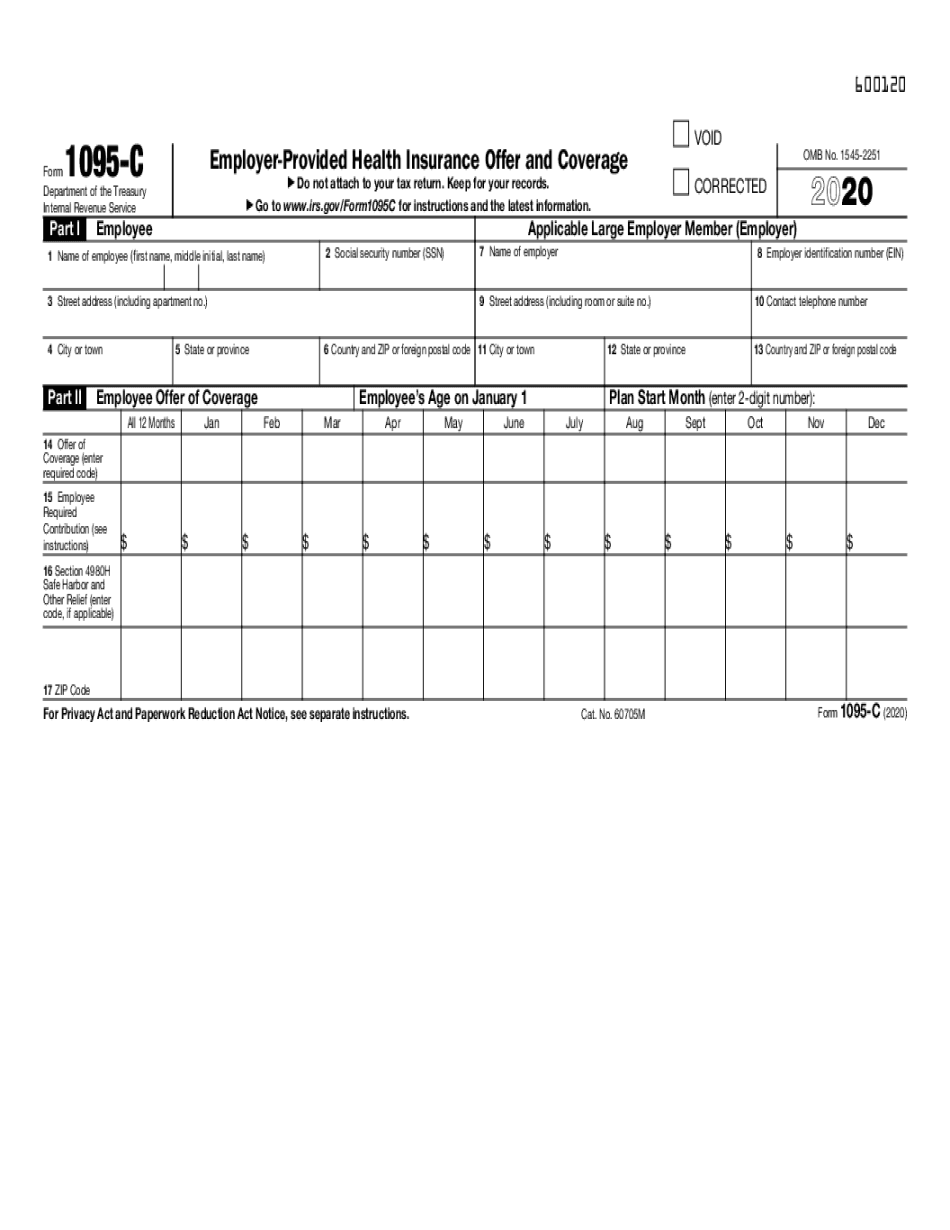

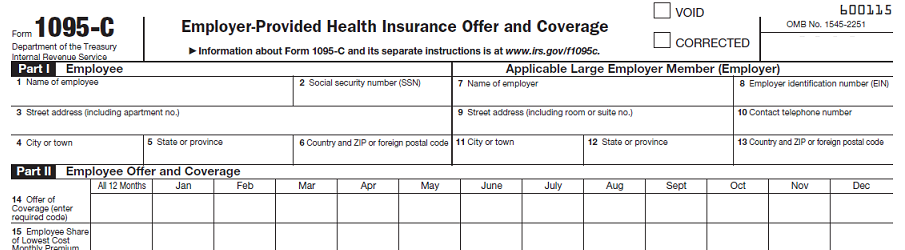

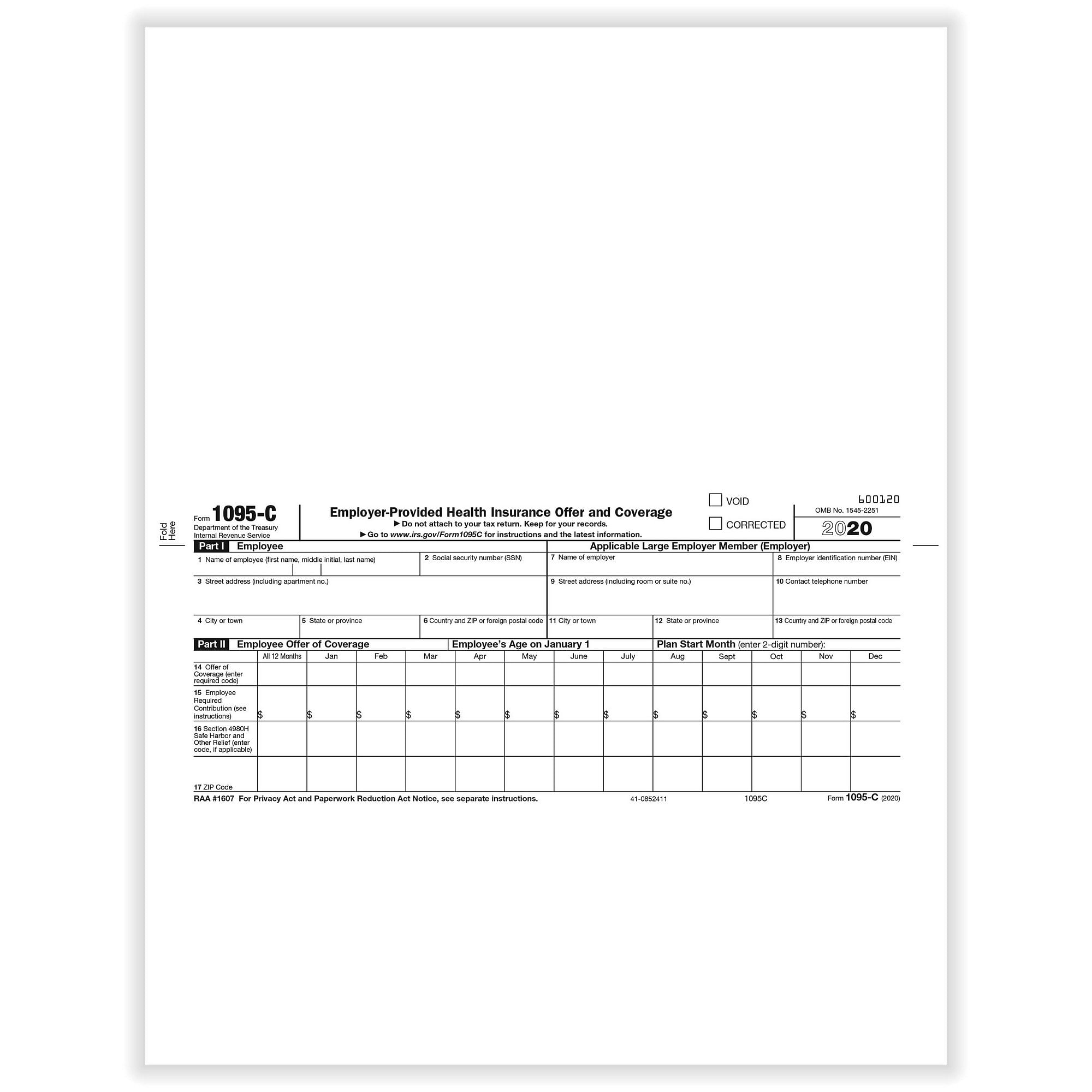

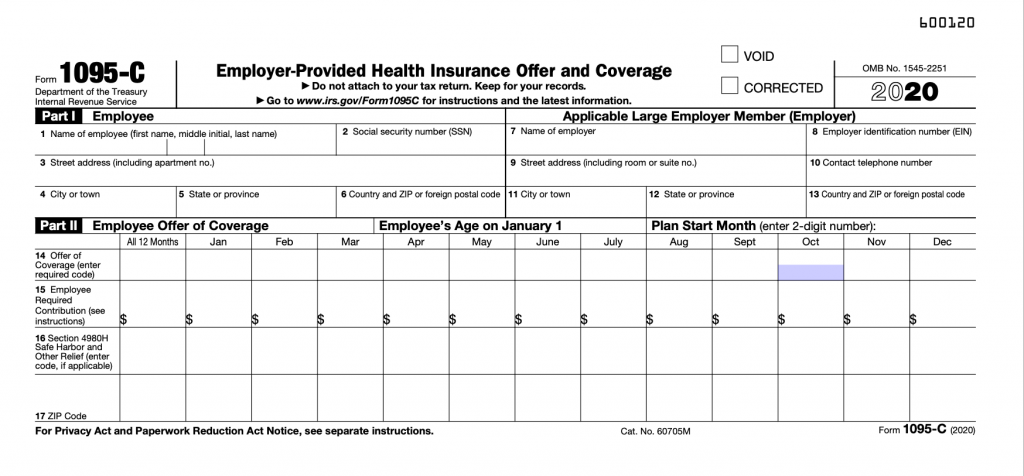

Form 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage 17 Form 1095C EmployerProvided Health Insurance Offer and CoverageWhat's on Form 1095A and why you need it Your 1095A contains information about Marketplace plans any member of your household had in , including Premiums paid;Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage

1095 C Continuation Forms Official Irs Version Zbp Forms

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

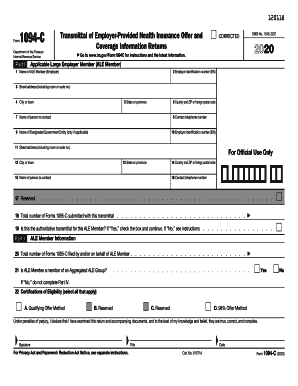

Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095CInst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095B Health Coverage Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1096Jun 06, 19 · You do not have to enter a 1095C in TurboTax You will answer the question in the Health Insurance section that you had health insurance all year and keep a copy of the 1095C with your tax records The insurance company will provide the IRS with the needed information

1095 C Form 21 Irs Forms

1094 C Irs Transmittal For 1095 C Forms For 5500 Tf5500

CODES FOR IRS FORM 1095C CODE SERIES 1 (continued) 1J Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage conditionally offered to spouse;Form 1095C FAQ's Reporting Year The Affordable Care Act requires that large employers provide each fulltime, benefitseligible employee receiving health insurance benefits, a 1095C report This report provides details of employee's enrollment in medical coverageFeb 22, 21 · Before March 2, 21 eligible employees will receive a Form 1095C tax document, which reports information about your medical coverage in While you will not need to include your 1095C with your tax return filing, or send it to the IRS, you may need information from your 1095C to help complete your tax return

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Irs Provides Aca Reporting Relief For Compliance Guidance

IRS Form 1095C Filing Instructions for 21 Updated November 05, 800 AM by Admin, ACAwise Every year, ALEs (Employers with 50 employees) must report to the IRS about their offered health coverage information to the employees The information is to be reported through Form 1095C under section 6056ACA Form 1095C Codes Sheet An Overview Updated October 14, 800 AM by Admin, ACAwise The IRS requires ALEs to report their employee's health coverage information on Form 1095COct 29, · The new 1095C codes have not been applicable to any tax years outside of Employers, read on to learn what they mean and how to use them accurately2 minute read We recently covered the ins and outs of the ACA's Form 1095C Now, we will be covering the new codes that are anticipated for the tax

Instructions For Forms 1095 C Taxbandits Youtube

Form 1095 C Guide For Employees Contact Us

Information about Form 1095C, EmployerProvided Health Insurance Offer and Coverage, including recent updates, related forms, and instructions on how to file Form 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to administer the shared employer responsibility provisions of section 4980HOct 15, · IRS Notice 76 provides additional relief from penalties under Section 6722 to providers of minimum essential coverage (MEC) that fail to furnish Form 1095B or Form 1095C to individuals that were not fulltime employees for any month of the year, under certain conditionsThe Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to capture enough information about the employer's offer of

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

trix Irs Forms 1095 C

Business Rules Versions PDF and CSV Formats ZIP Posted (Version 10) Back to AIR TY Main PageThe IRS will not impose a penalty for failure to furnish Form 1095C to any employee enrolled in an ALE member's selfinsured health plan who is not a fulltime employee for any month of if certain conditions are met See Notice 76 and Information reporting penalties Extension of good faith relief for reporting and furnishingFeb 08, 21 · In late February 21, the Health Care Authority (on behalf of your employer) will mail Forms 1095C to state agency, highereducation, and commodity commission employees enrolled in Uniform Medical Plan (UMP) Employees determined "fulltime" under Affordable Care Act regulations will also receive the form

Aca Processing 1095 B 1095 C

Individual Coverage Hra Ichra Reporting

Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review the codes used and determine whether you are compliant with your employer mandate ACA requirements ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095CMembers on an ASO/SelfInsured Commercial Health Plan receive Form 1095C from their Employer You do not have to wait for either Form 1095B or 1095C from your coverage provider or employer to file your individual income tax return You can use other forms of documentation, in lieu of the Form 1095 information returns to prepare your tax return

1095 C Form Official Irs Version Discount Tax Forms

Aca Forms

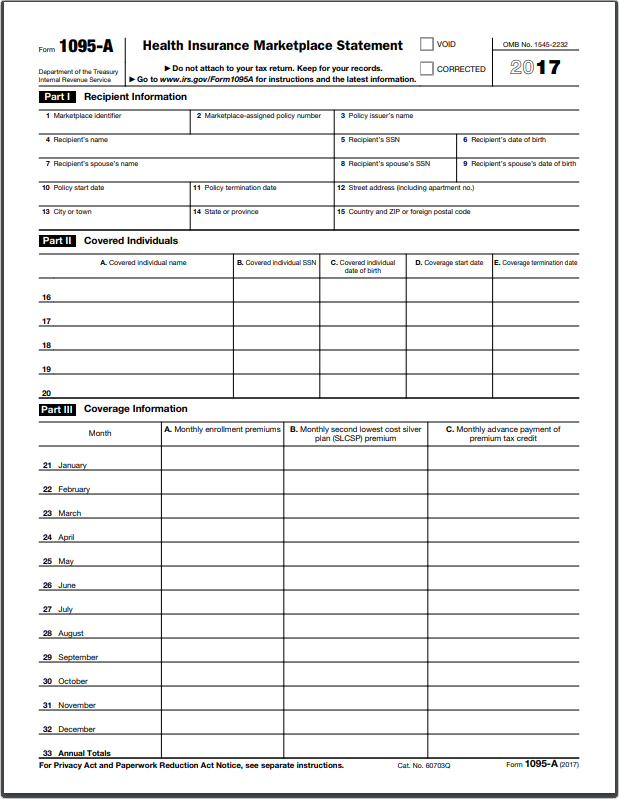

On Form 1095A statements furnished to recipients, filers of Form 1095A may truncate the social security number (SSN) of an individual receiving coverage by showing only the last four digits of the SSN and replacing the first five digits with asterisks (*) or Xs Truncation isn't allowed on forms filed with the IRSA figure called "second lowest cost Silver plan" (SLCSP) You'll use information from your 1095A to fill out Form 62, Premium Tax Credit (PDFIn the coming weeks, you may receive a tax document called the 1095C that will contain detailed information about your healthcare coverage if you were eligible in While you will not need to include your 1095C with your tax return, or send it to the IRS, you may use information from your 1095C to help complete your tax return

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

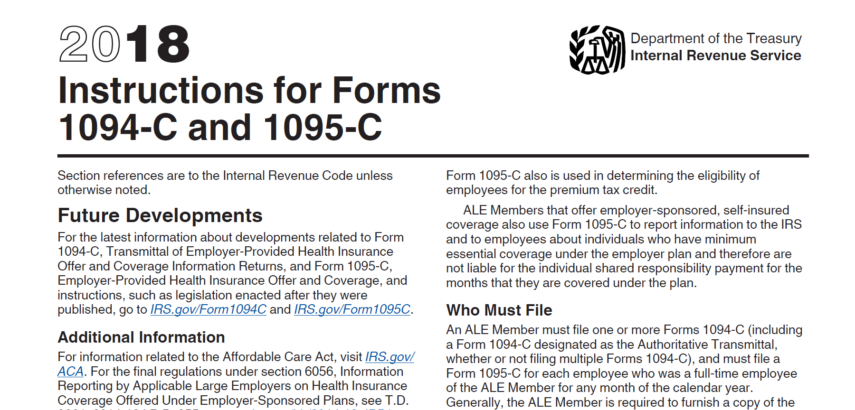

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Nov 11, · The new form covers HRA plan years starting Jan 1, New codes for the 1095C For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employeesSep 23, · September 23, 1211 Line 15 on the 1095C is for the employee required contribution Line 15 is only required if you entered code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, 1U on line 14Apr 27, 21 · See Form Filer Common Fields Filer fields common to all form types See Recipient Common Fields Recipient fields common to all form types Record Type 1 Text Record Type is a required field and it indicates if a record is the Responsible Individual/Employee Use E for Employee/Responsible Individual & C for Covered Individual Box 1 6

Guide To Form 1095 H R Block

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

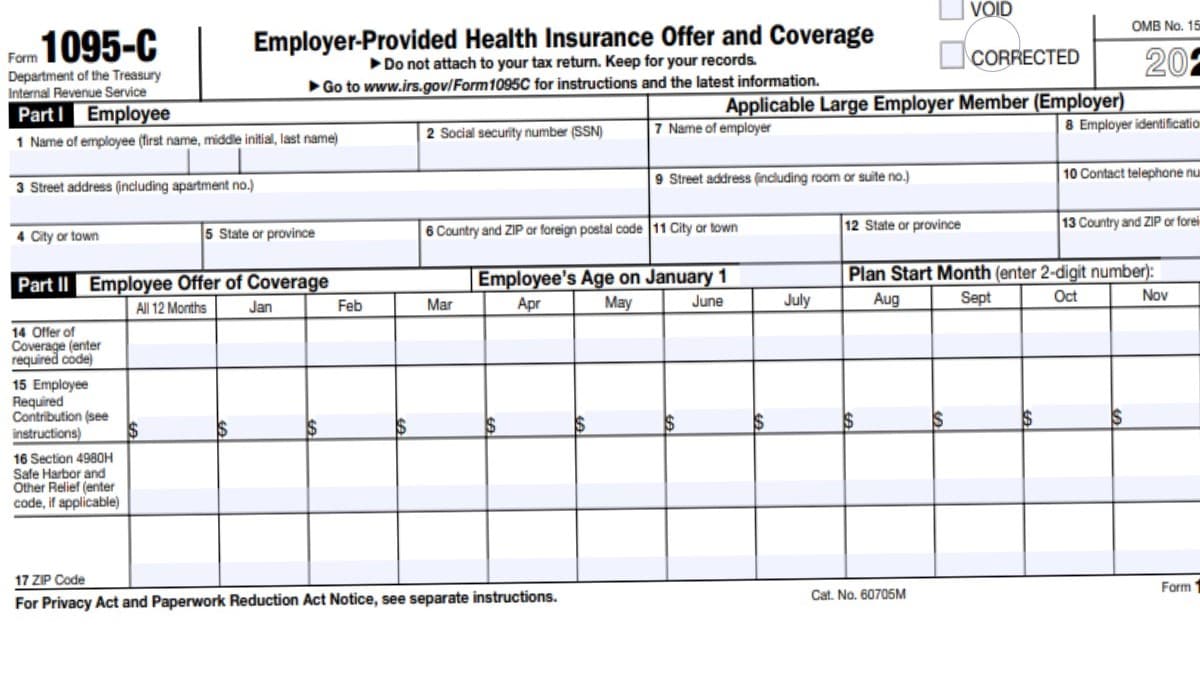

Form 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No Part I Employee 1 Name of employee (fYou will need this form to complete and report your coverage on your income tax return Please keep IRS Form 1095B for your records The VA will also provide IRS Form 1095B to the Internal Revenue Service for every Veteran who received health care coverage through VA in calendar year , as required by lawThere is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21

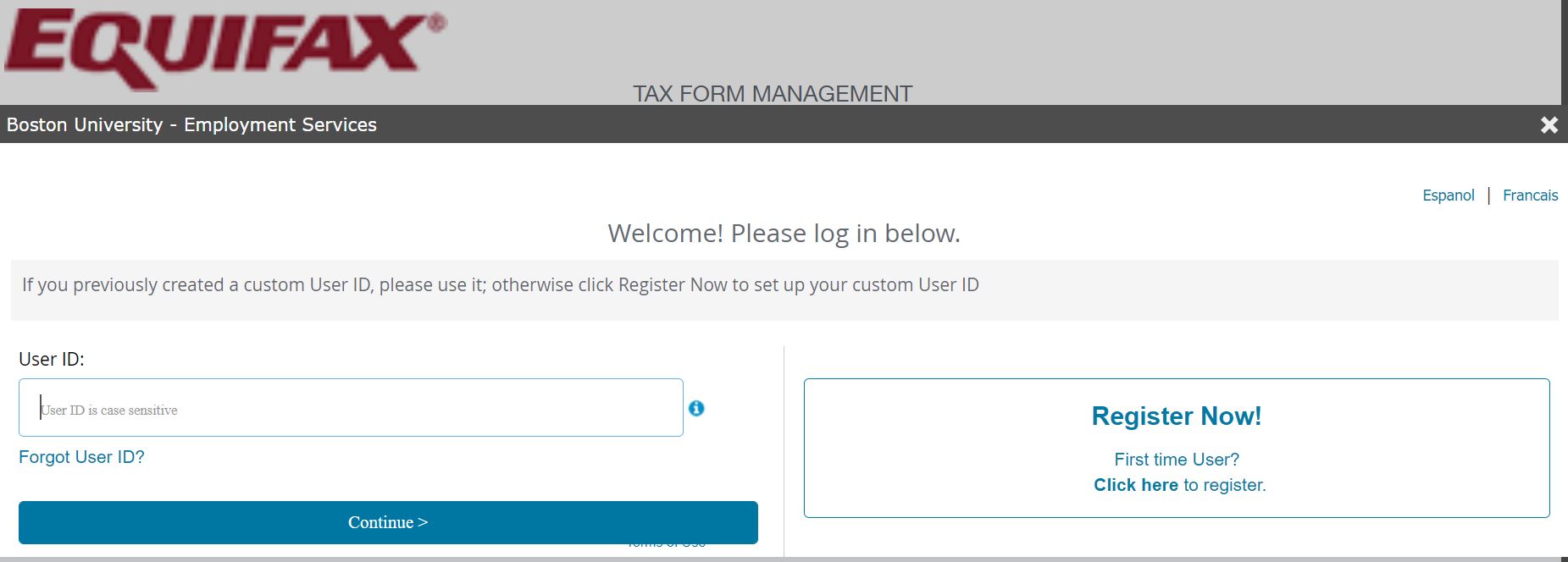

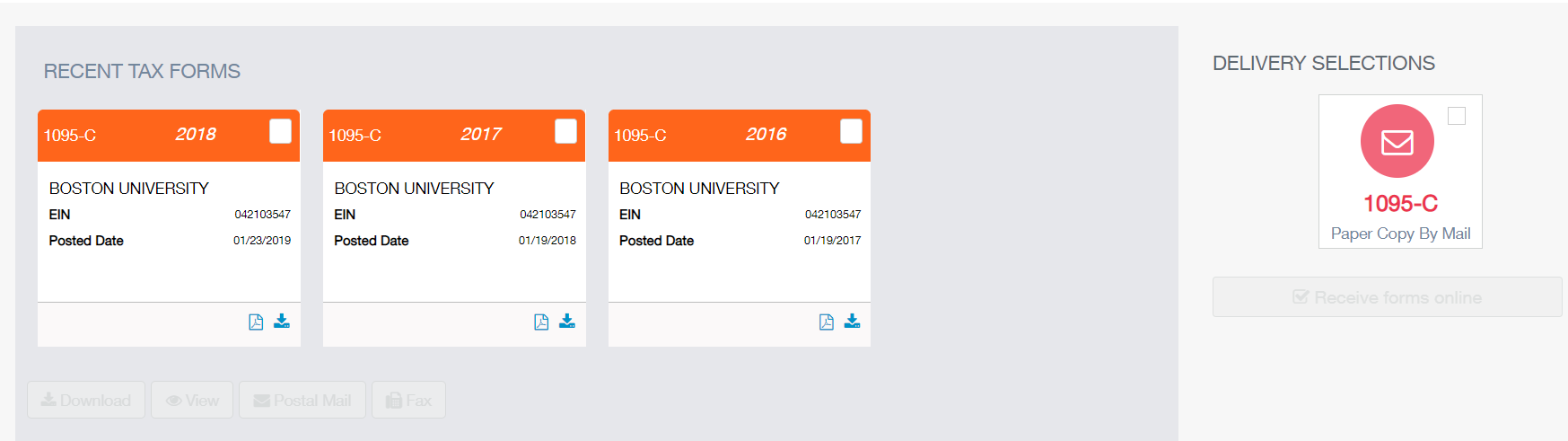

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

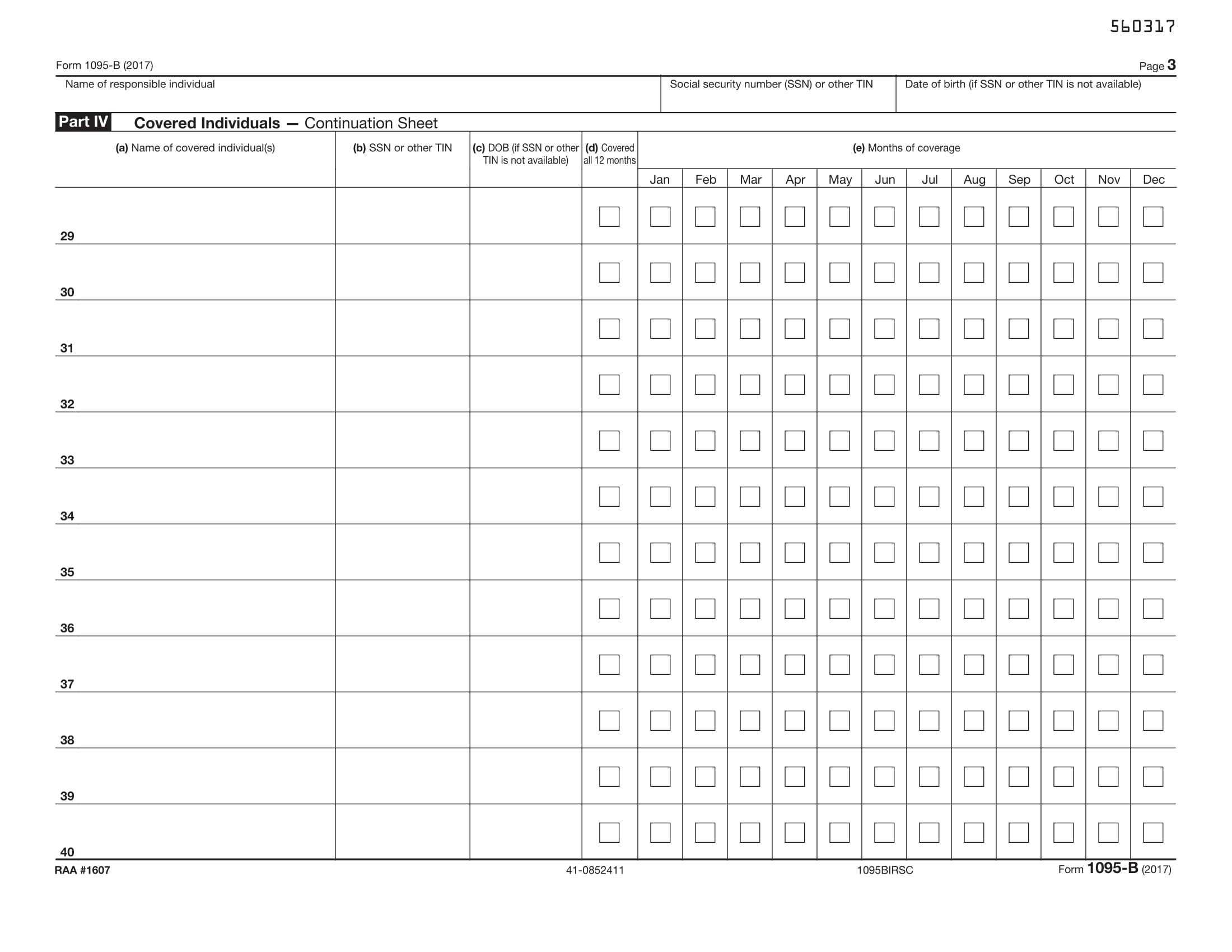

Minimum essential coverage not offered to dependent(s) (See Conditional offer of spousal coverage, for anJan 29, 21 · In accordance with requirements of the Affordable Care Act and various reporting requirements of other jurisdictions, UC employees and retirees will receive 1095B and/or 1095C forms verifying their health coverage forRelease Memo PDF Updated () Schemas 1094B, 1095B, 1094C and 1095C ZIP () Version 10 Note Includes a DIFF file from the previous version;

1095 C Faqs Mass Gov

Form 1095 C Released New Codes New Deadlines

Oct 29, · ACA Form 1095C Filing Instructions An Overview Updated October 29, 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employeesForm 1095C is not required to be filed with your tax return If you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxAct return (Online or Desktop), click Federal

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Your Tax Forms W 2 And 1095 C One Spirit Blog

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Questions Employees Might Ask About 1095 C Forms Bernieportal

1095 C Form 21 Finance Zrivo

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

What Is Form 1095 C Acawise Youtube

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

1095 C Tax Form For Gwell

Form 1095 C Now Available Online At My Vu Benefits Vanderbilt News Vanderbilt University

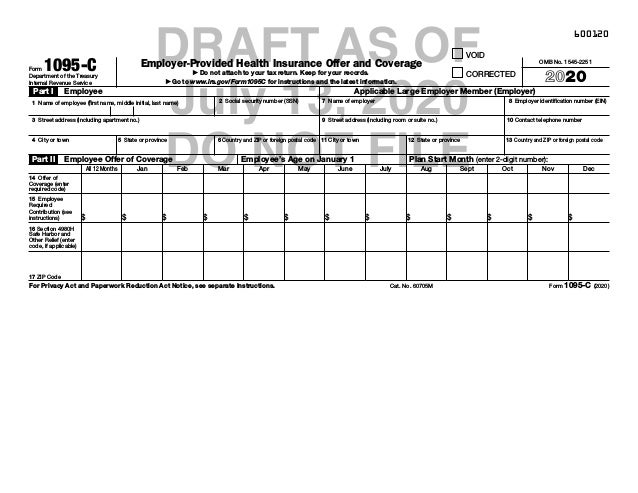

Form 1095 C Draft For Tax Year Released By Irs Boomtax

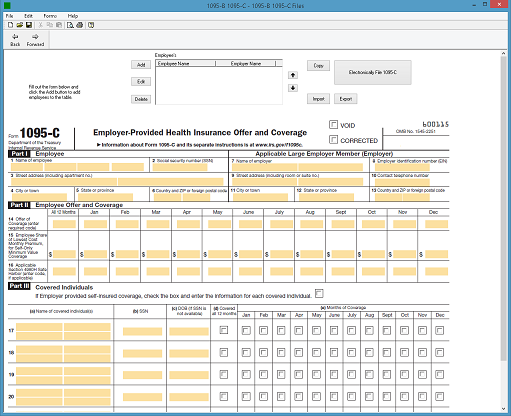

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

1094 C 1095 C Software 599 1095 C Software

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Accurate 1095 C Forms Reporting A Primer Integrity Data

Employer Aca Reporting Final Forms Lawley Insurance

The New 1095 C Codes For Explained

Irs 1095 C Form Pdffiller

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Your 1095 C Tax Form For Human Resources

1095 C Employer Provided Health Insurance Offer And Coverage Form 250 Sheets Pack

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Irs 1095 C Draft Form

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 C Employer Provided Health Insurance Irs Copy For 5096l Tf5096l

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Ez1095 Software How To Print Form 1095 C And 1094 C

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 C Faqs Office Of The Comptroller

Changes Coming For 1095 C Form Tango Health Tango Health

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 C Forms Human Resources Vanderbilt University

What Your Clients Need To Know About Form 1095 C Accountingweb

Ez1095 Software How To Print Form 1095 C And 1094 C

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

1095 C Irs Employer Provided Health Insurance Offer And Coverage Continuation Form Landscape Version 25 Sheets Pack

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

1095 C Preprinted Portrait Version With Instructions On Back

1095c Employer Provided Health Insurance Laser Form Item 1095c

Free 1095 C Resource Employee Faqs Yarber Creative

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Annual Health Care Coverage Statements

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Your 1095 C Tax Form For Human Resources

Irs Mailing Deadline February 28 Aca Gps

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Aca Deadlines Penalties Extension For 21 Checkmark Blog

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

1094 C 1095 C Software 599 1095 C Software

Aca Code Cheatsheet

Benefits 1095 C

Aca Forms

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1095 C Form Ts1099 Ts1099

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Irs 1095 C Draft Form

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 C H R Block

1095 C Form In Microsoft Dynamics Gp For

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

1095 C Form Official Irs Version Discount Tax Forms

Irs Form 1095 C Fauquier County Va

Accurate 1095 C Forms Reporting A Primer Integrity Data

7 Questions Employees Are Asking In About Aca 1095 Cs United Agencies Inc

19 Aca Reporting Timeline Pomeroy Group

Irs Form 1095 C Codes Explained Integrity Data

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Fedeli Group

What Your Clients Need To Know About Form 1095 C Accountingweb

0 件のコメント:

コメントを投稿